Source: The World Bank Report 2024

The Gulf Cooperation Council (GCC) region is undergoing a significant transformation as it seeks to diversify its economy and reduce reliance on oil revenues. Projections indicate that the GCC’s Gross Domestic Product (GDP) is expected to reach $3 trillion by 2030 and $6 trillion by 2050. The region strategically focuses on various sectors, including artificial intelligence (AI), renewable energy, healthcare, logistics, tourism, and technology. This article explores the economic outlook for the GCC, highlighting key initiatives, growth areas, challenges, and potential risks that could shape the region’s future.

Economic Diversification and Growth Projects

Historically, the economies of the GCC member states – Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Oman, and Bahrain – have been heavily reliant on oil exports. However, recent trends indicate a robust shift towards diversification. In 2023, while oil-related activities faced a slowdown due to OPEC+ production cuts, non-oil sectors demonstrated resilience with an average annual growth rate of approximately 4.5%. The International Monetary Fund (IMF) forecasts that this trend will continue, driven by increased government spending and private-sector investments.

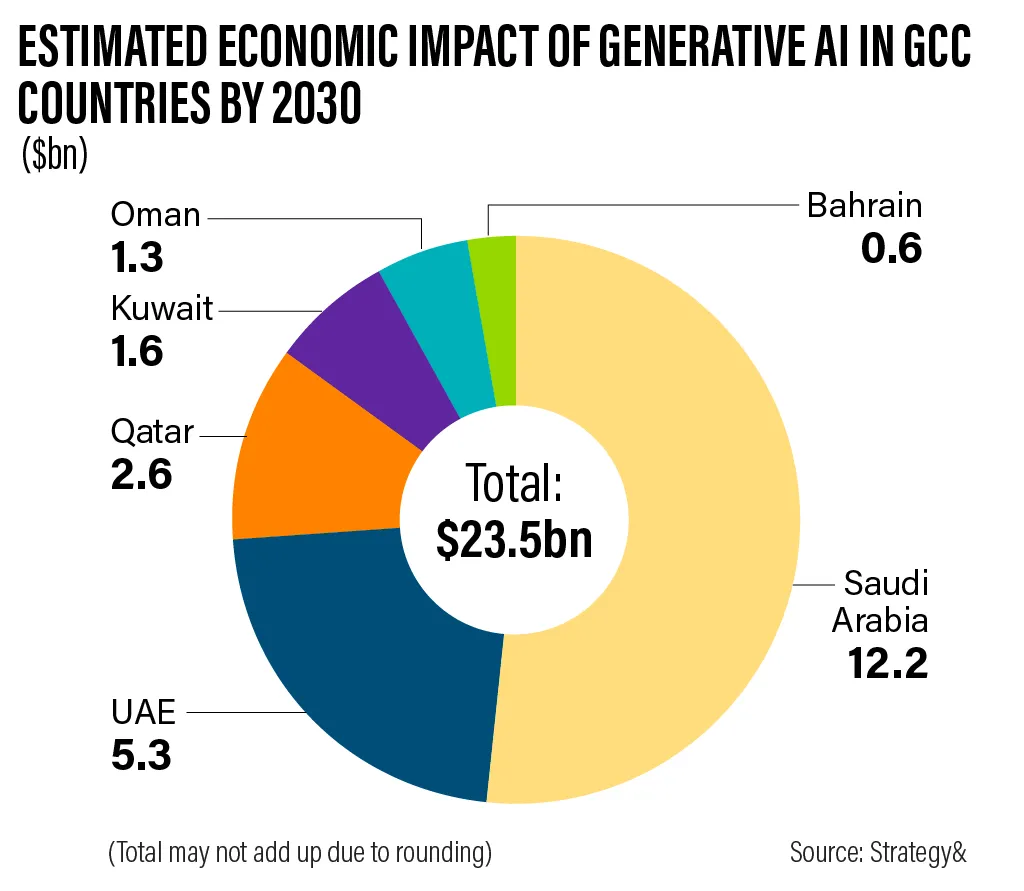

Artificial intelligence is a significant focus area for economic growth. The UAE has set ambitious goals through its National AI Strategy, aiming to position itself as a global leader in AI by 2031. This initiative is backed by investments projected to exceed $20 billion over the coming years. Similarly, Saudi Arabia’s Vision 2030 emphasizes technological innovation as a key driver of economic transformation, aiming to create a vibrant digital economy that fosters entrepreneurship and attracts foreign investment.

Artificial Intelligence: A Catalyst for Growth

Integrating AI technologies across various sectors is expected to significantly enhance productivity and efficiency in the GCC. The region is witnessing a surge in AI start-ups and initiatives to harness data analytics, machine learning, and automation to improve business processes. For instance, Dubai’s Smart City initiative seeks to leverage AI to enhance urban living through smarter transportation systems, improved public services, and efficient resource management.

Moreover, the GCC’s investment in AI aligns with global trends, where AI is projected to contribute approximately $15.7 trillion to the global economy by 2030. This presents an opportunity for GCC countries to improve their domestic economies and position themselves as leaders in the international AI landscape. However, the rapid adoption of AL also brings challenges. The need for skilled labor in technology-related fields is critical; thus, GCC countries must invest in education and training programs to develop a workforce capable of supporting these advancements. Additionally, regulatory frameworks must evolve to address ethical concerns surrounding AI usage and data privacy.

Renewable Energy Initiatives

As part of its commitment to sustainability and reducing carbon emissions, the GCC invests heavily in renewable energy projects. The region has established ambitious targets for renewable energy generation. For example, Saudi Arabia plans to generate 58.7 gigawatts (GW) of renewable energy by 2030, while the UAE aims to derive 505 of its power from clean resources by the same year. The Mohammed Bin Rashid Al Maktoum Solar Park in Dubai represents one of the largest solar projects globally and is essential to achieving these targets.

Moreover, Qatar is focusing on liquefied natural gas (LNG) as a cleaner alternative to oil, with plans to increase its LNG production capacity. This transition aims to meet domestic energy needs and positions the GCC as a critical player in global energy markets transitioning towards greener solutions. The renewable energy sector has already begun creating jobs; according to estimates from the International Renewable Energy Agency (IRENA), over 1 million jobs are expected in renewable energy across the GCC by 2030. However, challenges such as high initial investment costs and technological barriers remain hurdles that need addressing.

Healthcare Sector Growth

The healthcare sector is another area poised for significant growth within the GCC. With a rising population and increasing demand for high-quality healthcare services, governments are investing heavily in healthcare infrastructure and services. The COVID-19 pandemic highlighted vulnerabilities within healthcare systems globally; thus, GCC countries are prioritizing investments to enhance healthcare delivery systems. For instance, Saudi Arabia’s Vision 2030 includes plans to increase private sector participation in healthcare delivery while improving health outcomes through innovative technologies such as telemedicine and health informatics. The UAE has also made strides towards enhancing its healthcare system by integrating advanced technologies into patient care processes. According to estimates from industry analysts, healthcare spending in the GCC is expected to reach $104 billion by 2025 as governments seek to improve health services and outcomes for their populations.

Logistics and Trade Development

The logistics sector is crucial in facilitating trade within the region and internationally. With strategic geographical locations along major trade routes between Europe and Asia, GCC countries invest in logistics infrastructure to enhance their competitiveness as global trade hubs. Investments in ports, airports, and logistics hubs are designed to improve supply chain efficiency and support economic diversification. For example, Dubai’s Jabel Ali Port is one of the largest ports in the Middle East and serves as a vital gateway for trade between East and West. Similarly, Saudi Arabia has launched several mega-projects to develop logistics infrastructure under its Vision 2030 framework.

Tourism: A Growing Sector

Tourism has emerged as a significant contributor to economic diversification efforts within the GCC region. Countries like Saudi Arabia are making substantial investments to attract international tourists through initiatives such as “Saudi Seasons.” which promote cultural events throughout the year. The UAE continues to be a global destination for tourists; Dubai alone attracted over 16 million visitors in 2019 before the pandemic. As travel restrictions ease post-COVID-19 pandemic, recovery efforts are underway across various sectors, including the hospitality and entertainment industries, to revitalize tourism growth. Despite these positive developments, challenges, such as fluctuating global travel trends influenced by geopolitical tensions or economic uncertainties, could impact visitor numbers negatively.

Environmental Approaches: Sustainability Initiatives

The GCC is recognizing the importance of sustainable development in their economic strategies. Initiatives aimed at environmental conversation and sustainable urban development are gaining traction across the region. For instance, Bahrain has launched projects to improve water management and reduce waste through innovative technologies. Despite these advancements, environmental initiatives face significant challenges, such as water scarcity and extreme weather conditions exacerbated by climate change. The World Bank highlights that addressing these ecological risks is crucial for ensuring long-term economic stability and resilience in light of global warming.

The GCC’s commitment to sustainability also includes efforts to reduce carbon footprints through investments in green technologies. For example, Abu Dhabi’s Masdar City, with its focus on renewable energy sources and sustainable living practices, serves as a model for sustainable urban development.

Business Environment: Opportunities and Challenges

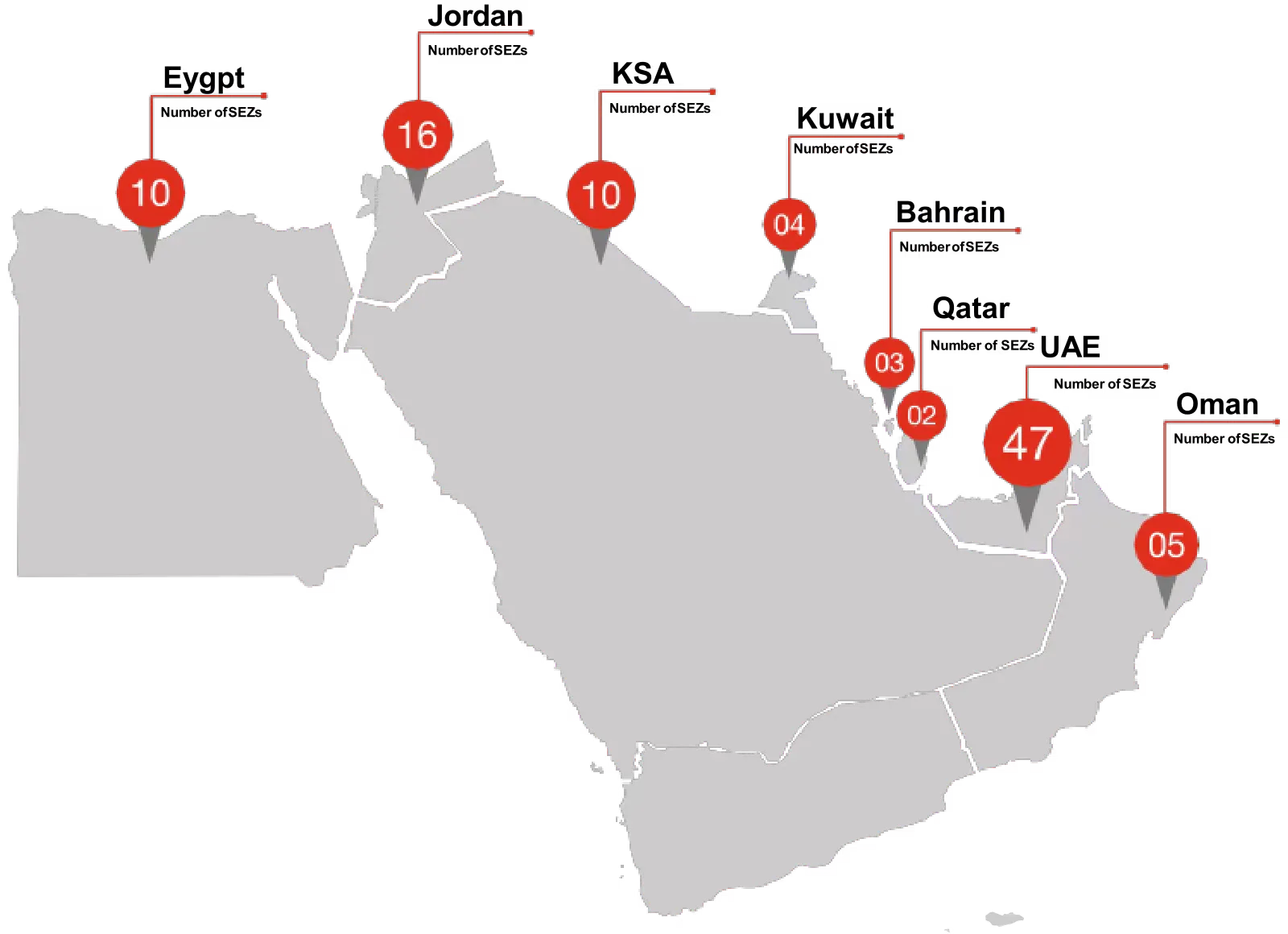

The business landscape within the GCC is evolving rapidly due to governments implementing reforms designed to enhance the ease of doing business. These reforms include reducing bureaucratic hurdles, improving regulatory frameworks, and fostering a culture of innovation through startup incubator funding programs. Establishing free zones across various emirates has encouraged foreign direct investment (FDI). The UAE alone attracted approximately $19 billion in FDI in 2022, reflecting its status as a regional business hub. Furthermore, while many GCC countries are making strides toward improving their business environments, issues such as bureaucratic inefficiencies and corruption still need to be addressed if they are genuinely committed to attracting more foreign investment.

Future Risks: Navigating Uncertainty

While the outlook for the GCC is generally positive, several risks could impede progress toward achieving economic diversification goals. Fluctuation in global oil prices remains a significant concern; although higher prices may provide short-term benefits through increased revenues, governments can lead to complacency regarding diversification efforts. Moreover, reliance on expatriate labor presents social challenges. Countries strive for greater nationalization workforces under initiatives like Saudi Arabia’s Saudization program. Balancing local employment needs with economic growth will require careful policy planning.

The region also faces competition from other emerging markets that are aggressively pursuing similar diversification strategies. Countries like India and Vietnam position themselves as attractive alternatives to foreign investment due to lower labor costs and growing consumer markets. Additionally, while non-oil sectors are expected to thrive over the medium term—driven primarily by private consumption investments—there remains uncertainty regarding global economic conditions that could impact demand for GCC exports, particularly if recessionary pressures emerge elsewhere in the world economy, impacting trade flows negatively overall regional performance moving forward into next few years ahead requires vigilance adaptability responsiveness changing circumstances surrounding external factors influencing local dynamics significantly over the period ahead.

A path Forward

The GCC region stands at a crossroads as it seeks to redefine its economic future through diversification into artificial intelligence, renewable energy, healthcare logistics, and tourism technology. With ambitious GDP projections of $3 trillion by 2030 and $6 trillion by 2050, strategic investments in technology sustainability will be critical to achieving these goals.

However, navigating geopolitical tensions, regulatory barriers, environmental risks, and labor market dynamics will require coordinated efforts among member states. As GCC countries continue their journey towards economic transformation, focusing on innovation while addressing existing vulnerabilities will be essential in building resilient economies capable of thriving in an increasingly competitive global landscape. Ultimately, leveraging financial resources effectively fosters an environment conducive to business growth, and technological advancement can emerge a leader in sustainable development, ensuring long-term prosperity for citizens. A strategic focus on AI integration renewable energy development not only positions the region favorably within global markets but also enhances its ability to respond proactively to future challenges inherent in the ever-evolving economic landscape.

Login

Login