Source: Statista Turkey and Tourism Outlook

Turkey’s travel and tourism sector is a vibrant tapestry woven from its rich history, breathtaking landscapes, and diverse cultural heritage. As one of the most sought-after destinations in the world, Turkey has captivated millions of travelers with its unique blend of East and West, offering ancient ruins and coastlines to modern cities bustling with life. In recent years, the sector has not only rebounded from the challenges posed by global events but has also charted a remarkable growth trajectory. With tourism revenues reaching an impressive $23.22 billion in the third quarter of 2024 alone, Turkey is on track to solidify its status as a premier leisure and medical tourism destination. This report delves into the intricacies of Turkey’s travel and tourism landscape. It explores its revenue dynamics, competitive positioning within the global market, challenges, and future predictions that will shape the industry in the coming years.

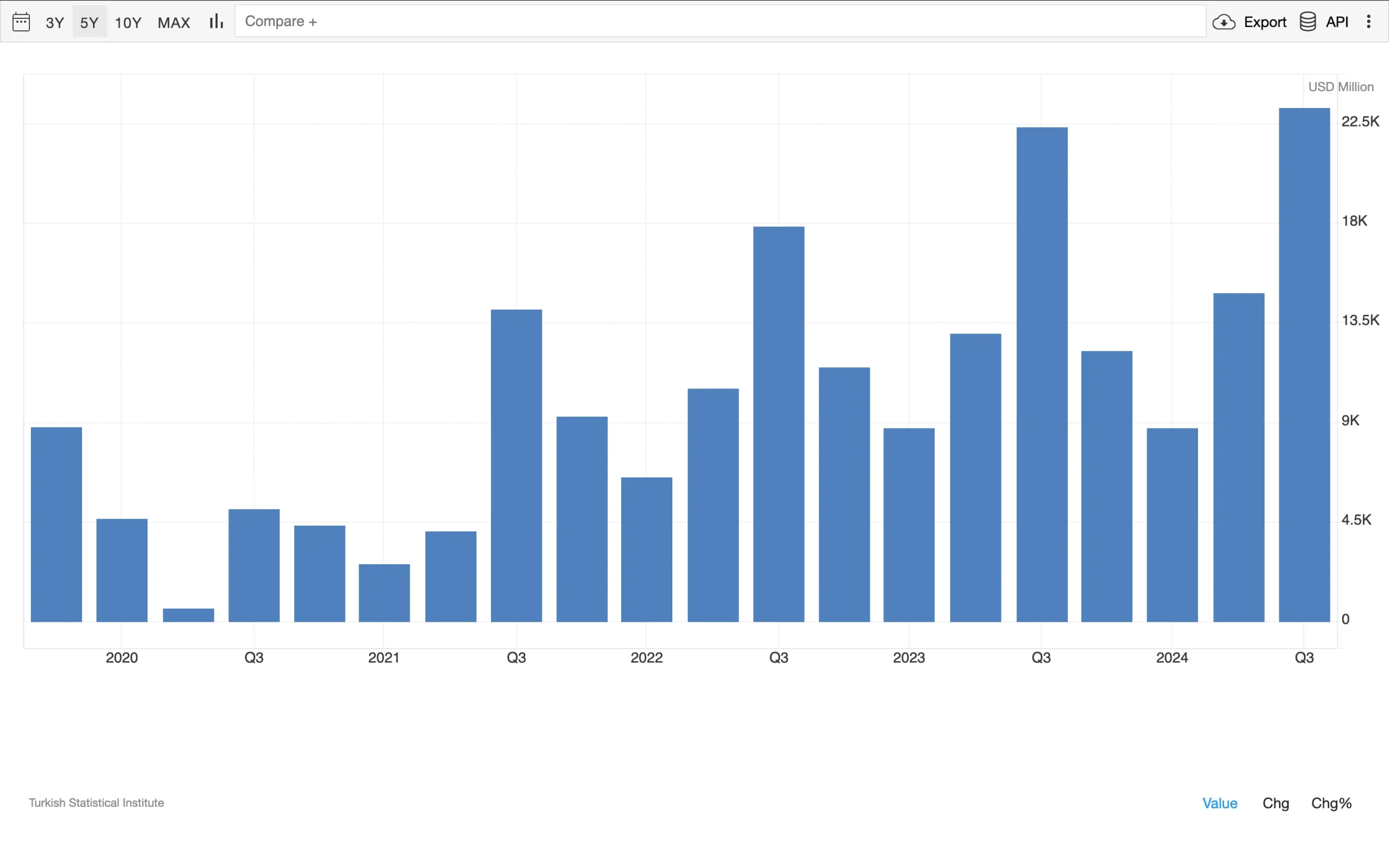

Overview of Turkey’s Tourism Revenue

As mentioned, in the third quarter of 2024, tourism revenue surged to $23.22 billion, reflecting a 3.9% year-on-year increase from the previous year. This revenue spike is particularly noteworthy given that it represents a rebound from the lows experienced during the pandemic. Historically, Turkey’s tourism revenues have demonstrated a strong upward trend. For instance, revenues increased from approximately $28.4 billion in 2019— prior to the pandemic– to a record high of $54,32 billion in 2023, marking a growth rate of 16.9% from $46.48 billion in 2022. However, there was a downward trend in revenues when comparing 2023 to 2024; despite substantial revenue recorded in Q3 2024, total revenues for 2024 are expected to be lower than those in 2023 due to several factors.

One significant reason for this anticipated decline is the changing dynamics in tourist spending patterns. Approximately 25 million tourists visited Turkey in the first half of 2024– a 13.2% increase year-on-year. Still, average expenditure per capita decreased by about 3.4%, resulting in lower overall spending despite higher visitor numbers. Additionally, shorter average stays– down by about 6.2% — indicate that while more tourists are arriving, they may not contribute much to local economics during their visits.

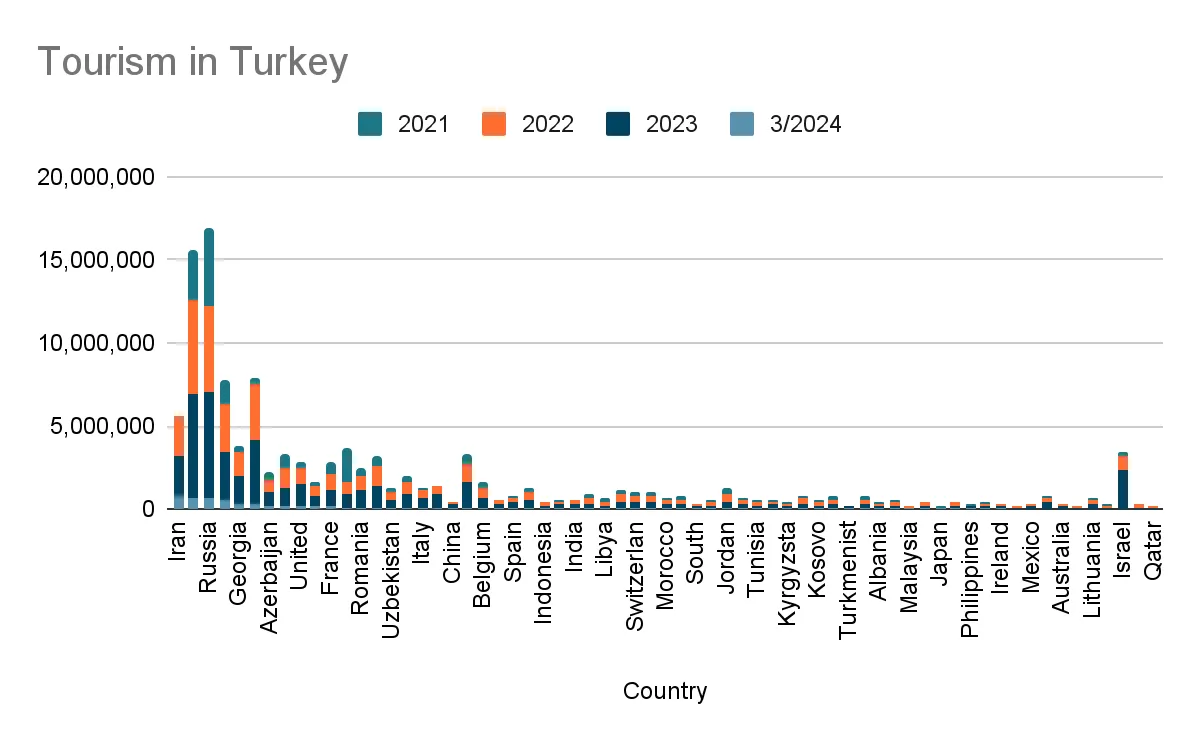

Tourist Demographics in Turkey

The report indicates that tourists visiting Turkey come from various nationalities, with proportions hailing from countries such as Germany, the UK, Russia, and neighboring Middle Eastern nations. In 2023, Turkey welcomed 4.55 million visitors from Russia, 4.38 million from Germany, and 3.1 million from the UK. Regarding gender distribution, male tourists slightly outnumber female visitors, although the gap is narrowing as more women travel independently; female travelers now account for about 48% of total visitors.

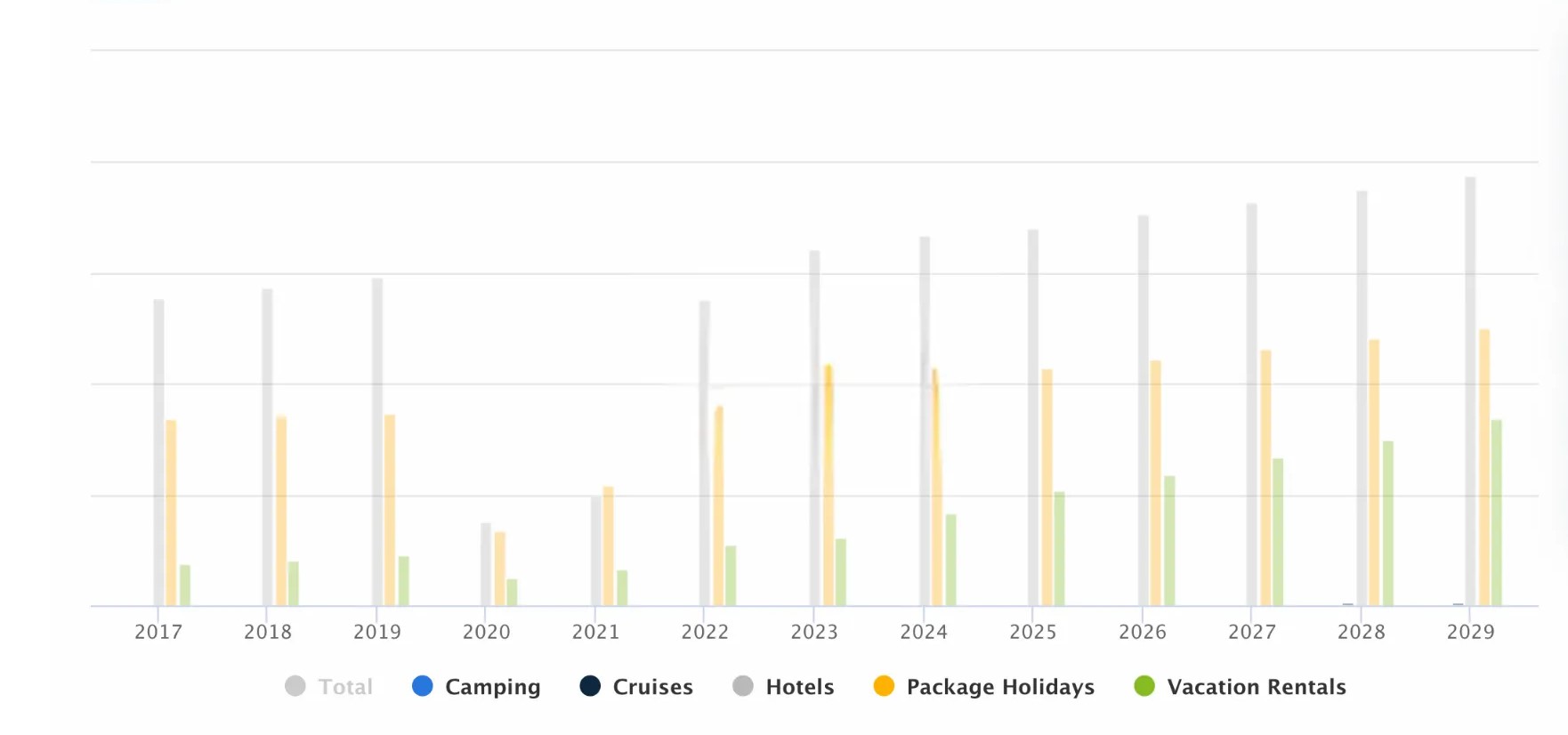

Age demographics reveal that most visitors fall within the 25 to 34 age range, indicating a vibrant interest among younger travelers in exploring Turkey’s rich cultural heritage and natural beauty. The age group represents 30% of all tourists. The average length of stay for tourists in Turkey is around 7.5 days, allowing ample time to immerse themselves in local experiences and attractions. Recent trends show that travelers increasingly seek unique and authentic experiences, moving away from traditional tourist hotspots to explore off-the-beaten-path destinations. Additionally, tourists opt for package holidays that combine accommodation, meals, and guided tours, reflecting a growing preference for convenience and value during their travels.

Categories in Turkey’s Tourism Sector

Turkey’s tourism sector encompasses various categories that signify its overall revenue generation. The largest share comes from package tours, which accounted for approximately 35.1% of total expenditures in Q3 2024, amounting to about $8.1 billion. This category is particularly popular among international tourists who prefer organized travel experiences, including accommodation, meals, and guided tours.

Following package tours are food and beverage expenditures, representing about 17.9% or roughly $4.17 billion of total tourism revenue during the same period. This highlights the importance of culinary experiences in attracting tourists; Turkey is renowned for its rich cuisine that reflects its diverse cultural influences.

International transport also plays a crucial role in Turkey’s tourism revenue structure, constituting about 10.9%, or approximately $2.54 billion, in Q3 2024. This includes spending on flights operated by Turkish Airlines and other international carriers that bring tourists into the country.

Additionally, other vital categories include accommodation services (which often overlap with package tours), cultural activities (such as museum visits and historical site tours), sports activities (including skiing and water sports), and health-related expenditures linked to medical tourism– each contributing to enhancing Turkey’s appeal as a multifaceted tourist destination.

Medical Tourism Sector

Turkey has established itself as a leading destination for medical tourism, a sector that has become increasingly vital within its overall tourism landscape. By 2023, Turkey attracted approximately 1.4 million health tourists, generating around $2.3 billion in revenues from this sector alone. This achievement made Turkey the 7th largest country in health tourism globally. The country boasts over 50 internationally accredited health institutions, offering a wide range of medical services at competitive prices compared to Western countries– often at savings of up to 70% for procedures such as cosmetic surgery, dental work, and fertility treatments.

In the dental sector specifically, Turkey has become a popular choice due to its affordability and quality of care. For instance, the average cost of dental treatments in Turkey can be 70-90% cheaper than in the US or UK. Standard procedures include dental crowns, which typically range from $100 to $250, and implants, which can cost around $3650 for an “All on 4” implant system compared to $10,000 in the US. This significant price difference is a major draw for international patients seeking high-quality dental care at a fraction of the cost.

Looking ahead, Turkey aims to attract 2 million health tourists in 2024. Projections indicate that this segment could contribute approximately $3 billion in revenues. The dental market is expected to grow substantially, and forecasts estimate that the aesthetic market could reach $2.5 billion by 2027.

Comparison with Global Tourism Revenues

When comparing Turkey’s tourism revenues within the global context, it is essential to examine its position relative to other countries in the Middle East and North Africa (MENA) region and beyond. In 2024, Turkey is projected to generate about $12,5 billion in Q4 alone, contributing to an anticipated total revenue of $54 billion for the entire year. This places Turkey among the top destinations for international tourists despite competition from neighboring countries like the UAE and Egypt, which also vie for market share in tourism dollars. Turkey ranked 5th among European countries regarding international tourist arrival growth in 2023, welcoming over 57 million inbound visitors that year.

Challenges Facing the Sector

Despite its success, Turkey’s travel and tourism sector encounters several formidable challenges that could impede future growth prospects. Economic instability remains a concern; high inflation rates have adversely affected disposable income levels for both domestic and international tourists. In recent years, the inflation rate has fluctuated dramatically– peaking at over 80%– which has impacted affordability for potential visitors and made travel to Turkey less appealing than more stable destinations. Additionally, geopolitical tensions in the region have raised safety concerns among travelers; recent diplomatic disputes have resulted in travel advisories that deter visitors from Europe and North America– traditionally significant markets for Turkish tourism.

Furthermore, shorter average stays—down by about 6.2%—suggest that while more tourists are arriving, they may not contribute to local economies during their visits.

Future Predictions

Forecasts indicate that Turkey’s tourism industry is poised for continued growth as it adapts to changing consumer preferences and invests in enhancing its offerings across various segments. By 2025, total tourism revenues will reach approximately $16.5 billion, with a further increase expected beyond that year.

The medical tourism sector is auspicious; projections suggest it could grow from an estimated value of $3.43 billion in 2024 to $7.10 billion by 2029 at a compound annual growth rate (CAGR) of 15.65% during this period. Additionally, investment in infrastructure improvements, such as expanding airports and improving transportation networks, will play a crucial role in accommodating increasing visitor numbers while ensuring seamless travel experiences throughout Turkey’s diverse regions.

Login

Login