Source: The 2024 Geography of Crypto Report from Chainalysis

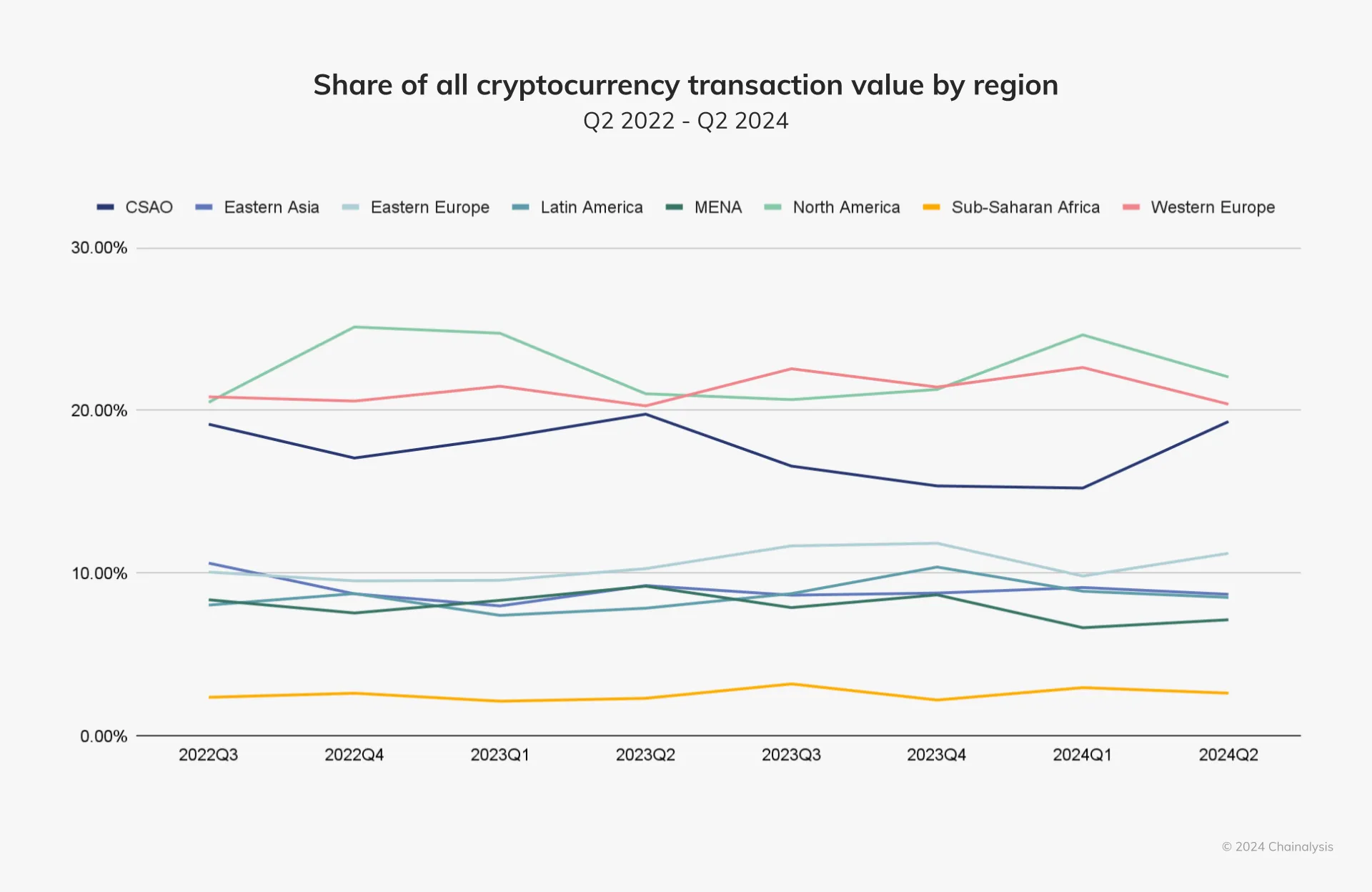

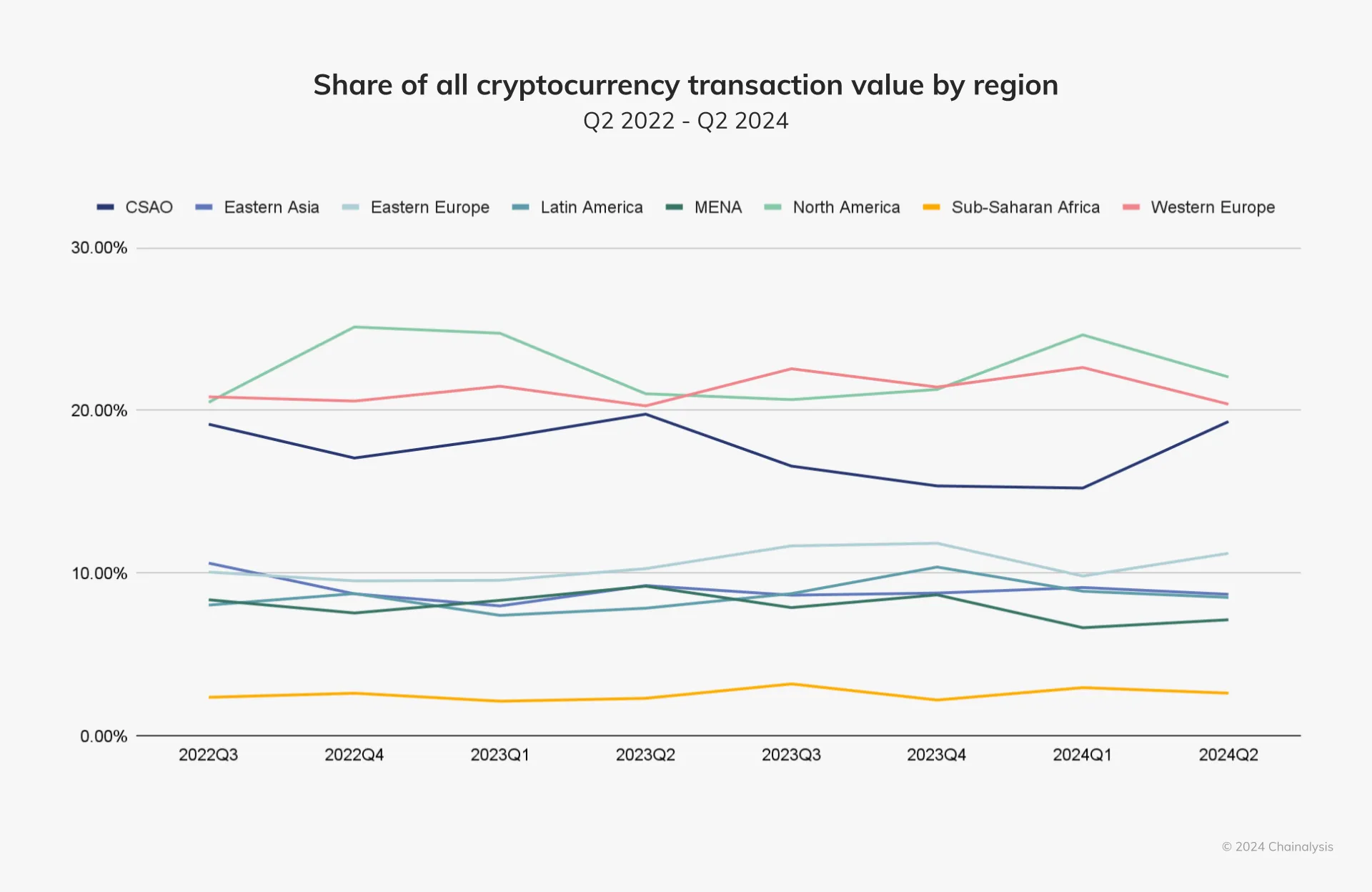

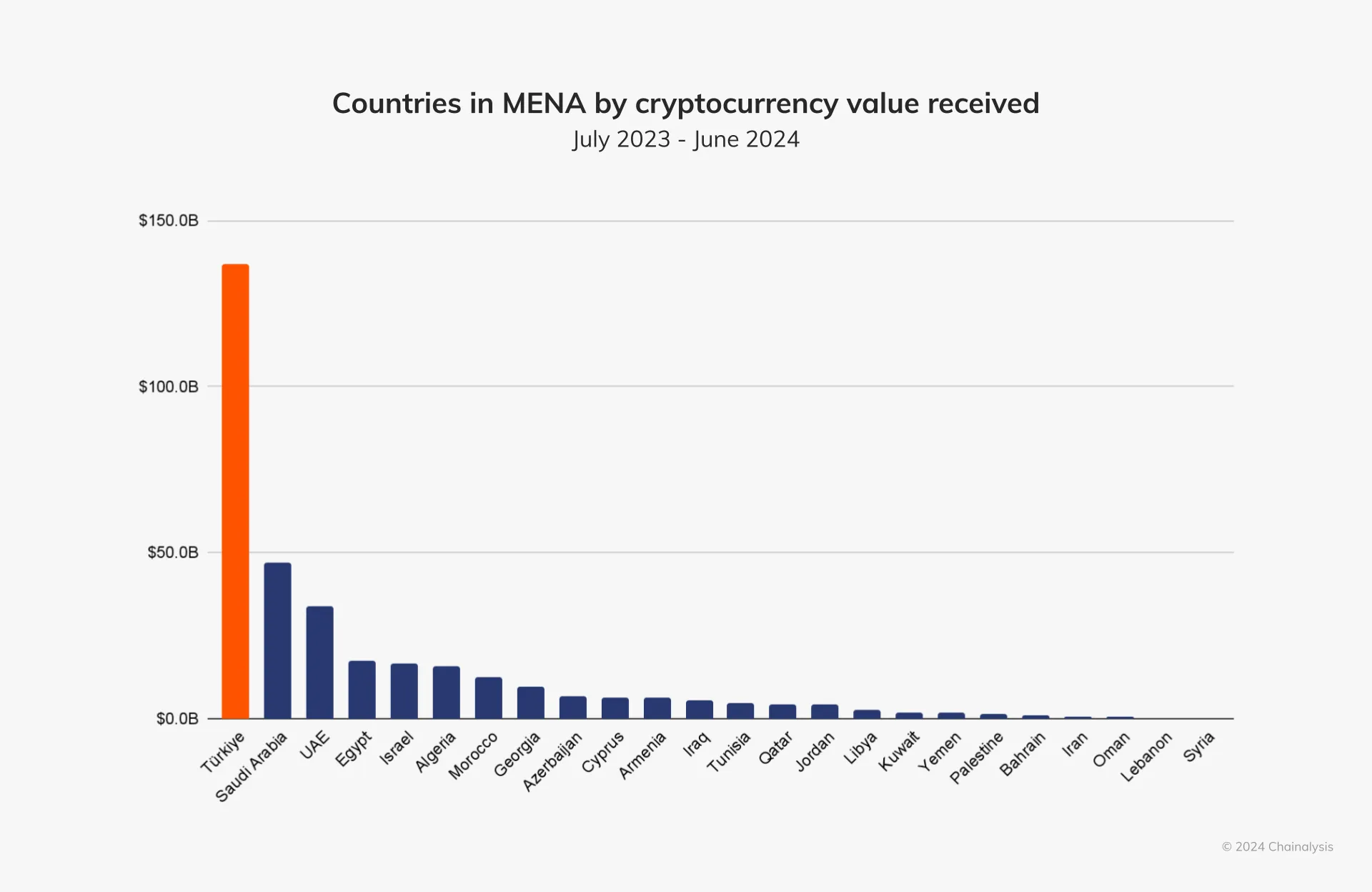

The Middle East and North Africa (MENA) region is experiencing a remarkable transformation in its financial landscape, rapidly emerging as a significant player in the global cryptocurrency market. As of 2024, MENA ranks as the seventh-largest crypto market worldwide, with an astounding on-chain value of $338.7 billion received between July 2023 and June 2024. This figure represents approximately 7.5% of the total global transaction volume. The increase in activity is not just a reflection of market size; it indicated a burgeoning interest in cryptocurrencies driven by institutional and retail investors across various regional countries.

Notably, MENA’s crypto market has witnessed a year-on-year growth rate of 11.73%, underscoring its resilience and adaptability in a rapidly changing financial environment. Most on-chain activity in the region occurs on decentralized exchanges (DEXs), with 32.4% of transactions in the United Arab Emirates (UAE) and 30.9% in Saudi Arabia taking place on these platforms.

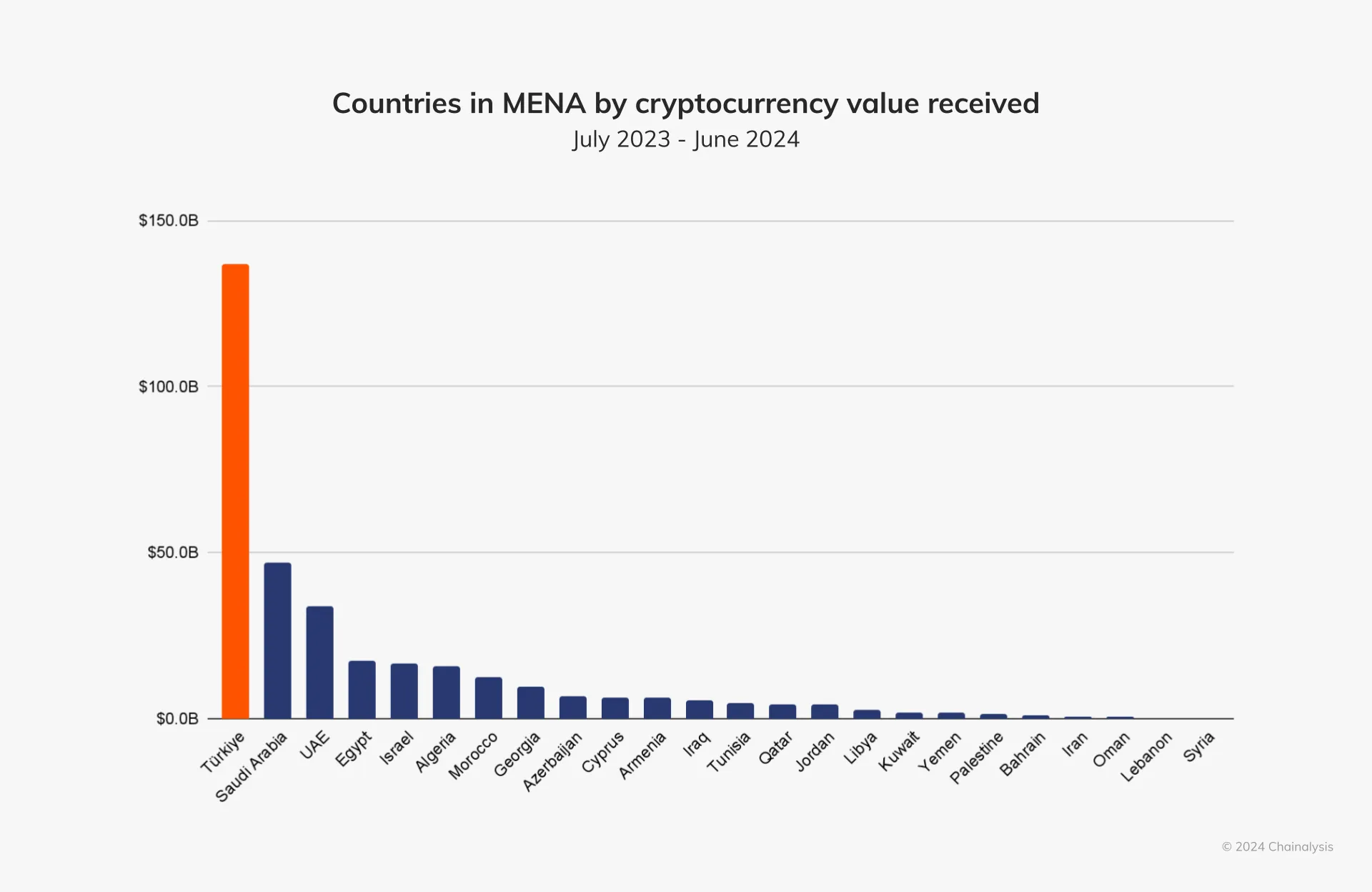

The concentration of crypto activity within MENA is particularly noteworthy, with a few key players dominating the scene. Turkey leads the region as its largest crypto marketer, securing the 11th position globally with $137 billion in value received during this reporting period. Morocco follows closely, ranking 27th globally with $12.7 billion in crypto transactions. Most of the transactions within MENA are substantial, with an impressive 93% of value transferred coming from transactions exceeding $10,000.

Turkey: The Regional Leader in Crypto Adoption

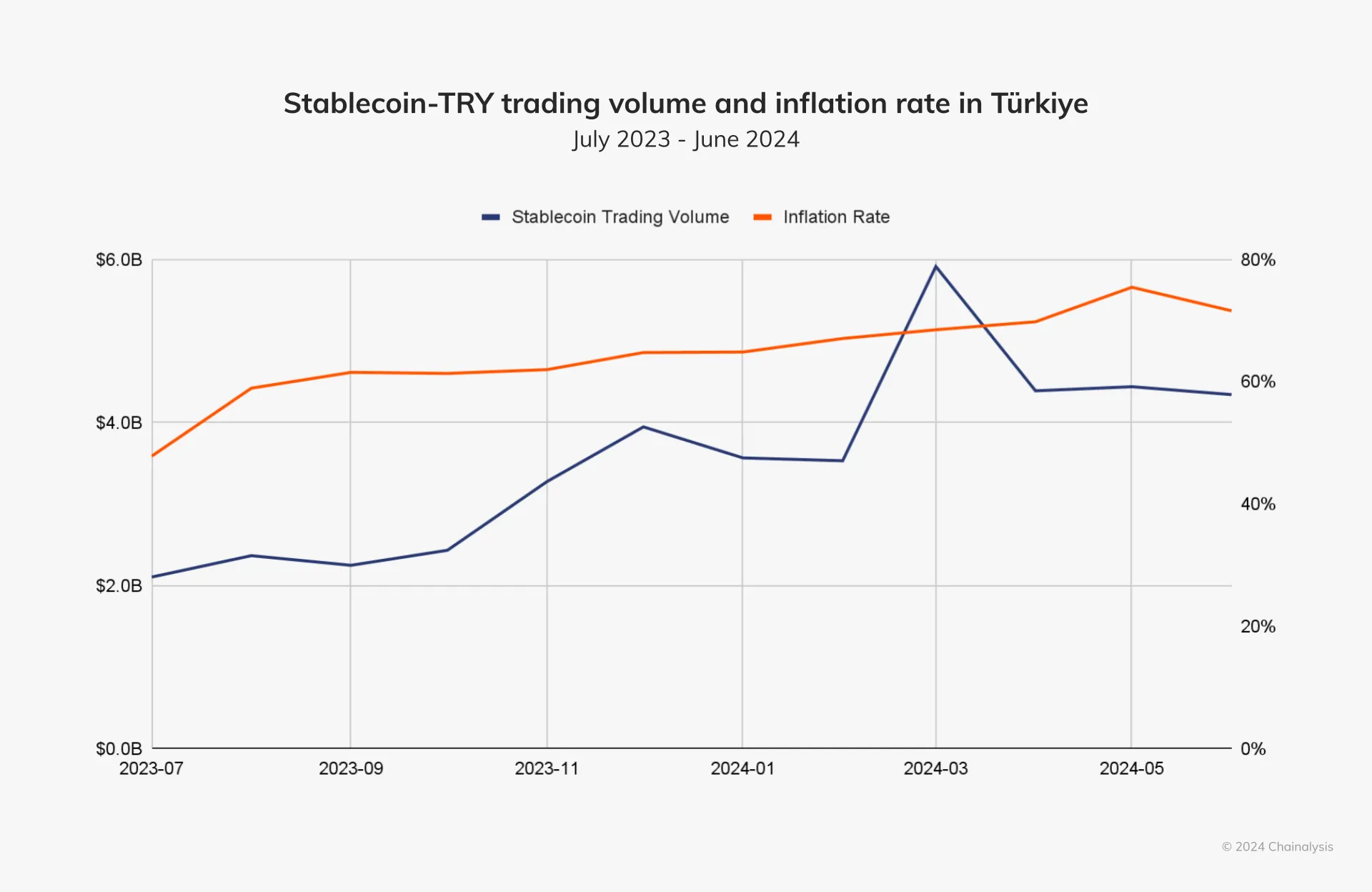

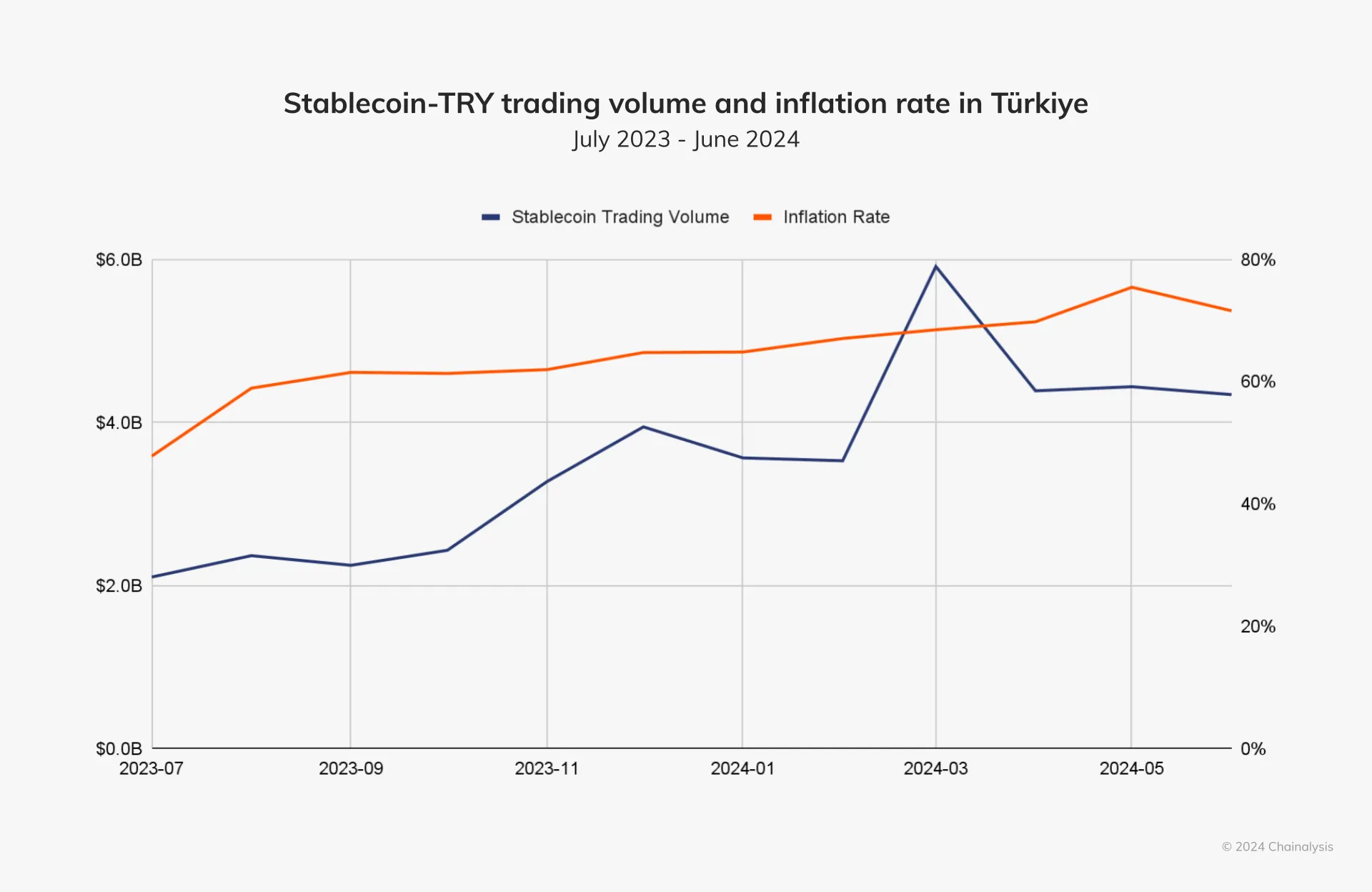

Turkey has emerged as the largest crypto market in the MENA region, with a staggering $137 billion received during the reporting period. This dominance can be attributed to several economic factors, including exceptionally high inflation rates that have persisted near or above 50%. As citizens grapple with financial instability and currency devaluation, many have turned to cryptocurrencies as a hedge against inflation and a means to preserve their wealth. Estimates suggest that approximately 40% to 50% of Turkey’s population engages with cryptocurrencies, showcasing a significant shift toward digital assets as investment opportunities and financial safeguards.

In addition to inflationary pressures, Turkey’s unique regulatory landscape plays a crucial role in shaping its crypto market. The country has seen increased interest from local and international exchanges, enhancing liquidity and trading volumes. Furthermore, Turkey leads the world in stablecoin trading volume relative to its GDP, indicating a strong preference for stable digital assets among its citizens. This trend reflects broader consumer behavior where individuals seek stability amidst economic uncertainty, driving demand for stablecoin like Tether (USDT) and USD Coin (USDC).

In addition to these economic factors, Turkey’s tech ecosystem fosters innovation within the crypto space. Local startups are developing blockchain-based solutions catering to domestic and international markers. For instance, Turkish fintech companies are exploring applications for blockchain technology across various sectors, including supply chain management and remittances. This entrepreneurial spirit is supported by government initiatives to promote technological advancements and digital literacy among the population.

The UAE: A Hub for Institutional Investment

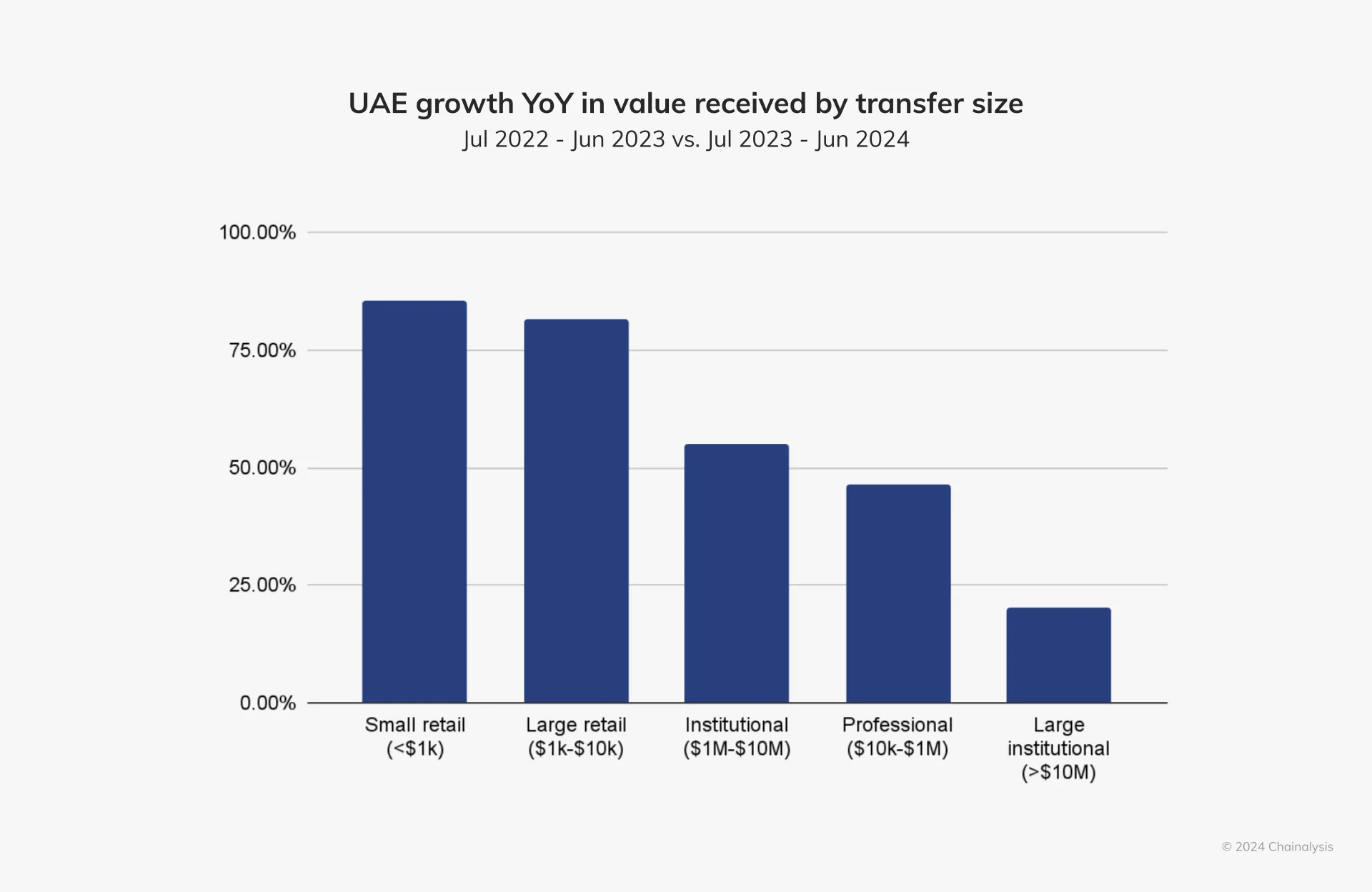

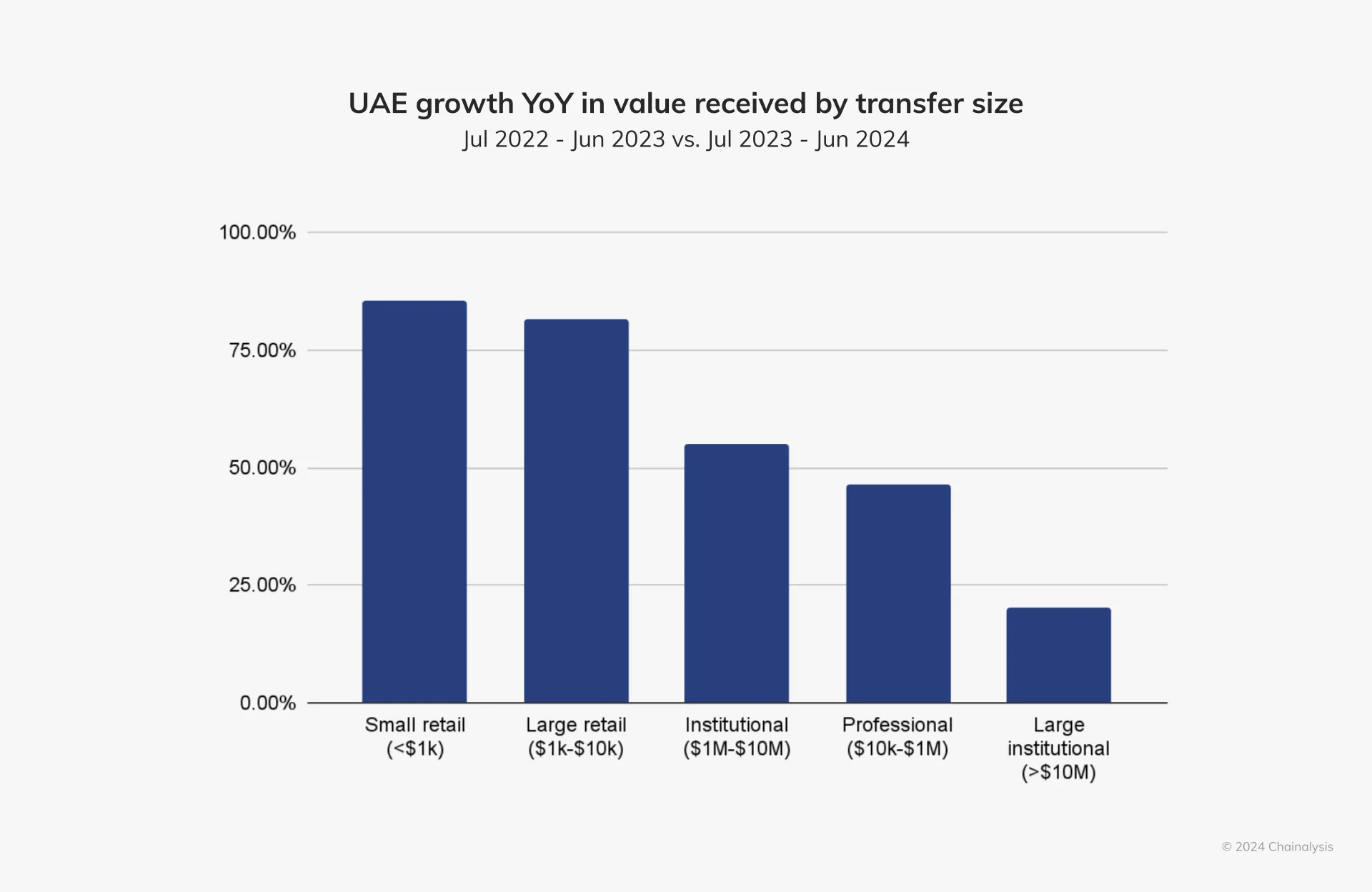

The United Arab Emirates (UAE) has emerged as a formidable player in MENA’s cryptocurrency landscape, ranking third with over $34 billion received between July 2023 and June 2024. This figure represents a year-on-year growth rate of 42%, outpacing the regional average of 11.73%. The UAE’s crypto activity spans all transaction sizes: small and large retail transactions, each growing by over 80%. Additionally, professional transactions increased by 46.3%, while institutional transfers surged by 55.07%. This balanced growth indicates a mature market where retail and institutional investors actively participate.

The UAE’s regulatory environment plays a huge role in fostering this growth. Authorities like the Dubai Virtual Assets Regulatory Authority (VARA) have established forward-focused regulations encouraging innovation while ensuring consumer protection. The introduction of clear regulatory frameworks has attracted numerous international firms looking to establish operations within the UAE’s borders, positioning Dubai as a global hub for cryptocurrency exchanges and blockchain startups.

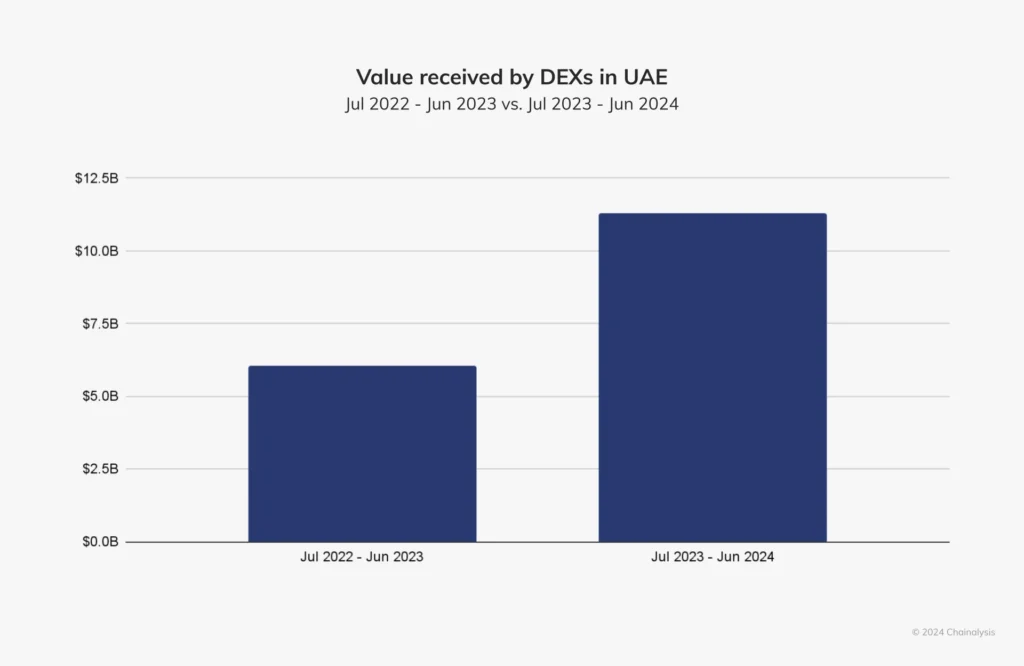

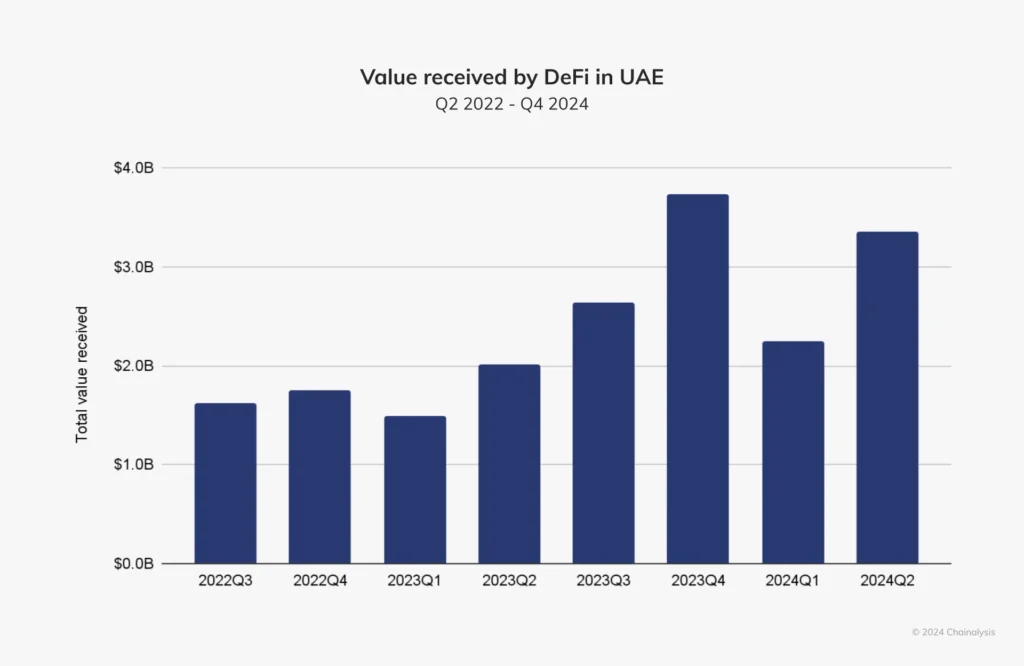

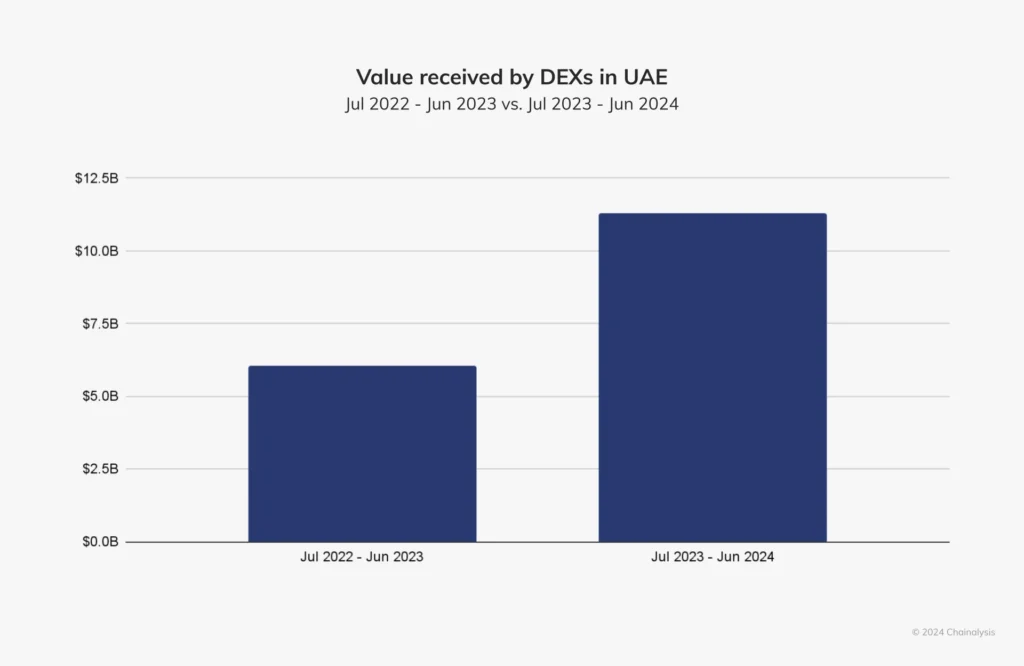

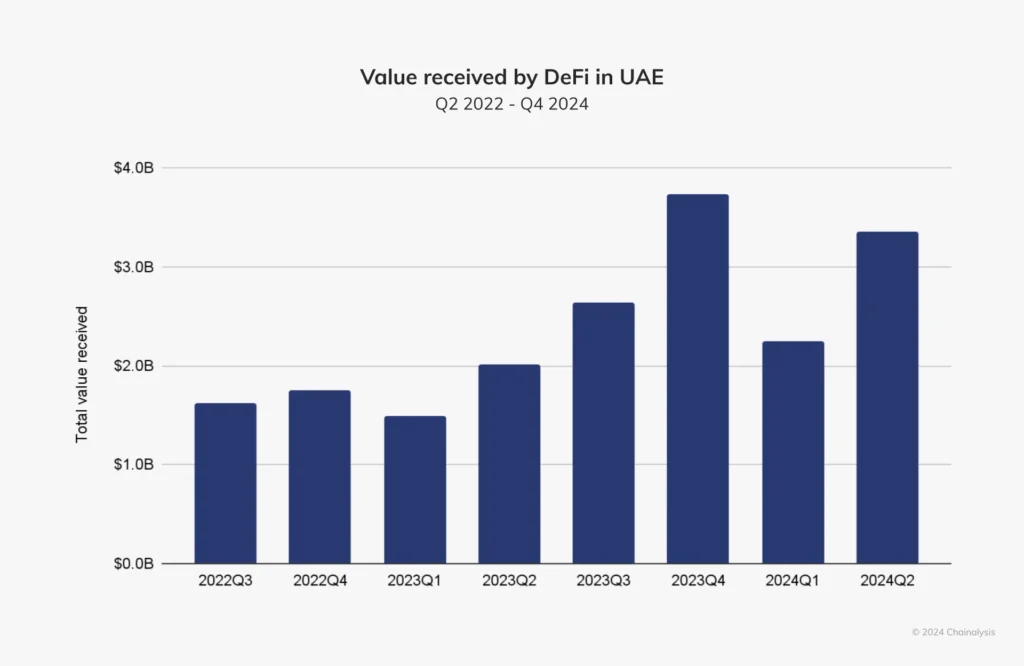

Moreover, decentralized finance (DeFi_ services have gained substantial traction within the UAE’s crypto ecosystem. The total value received by DeFi services grew by an impressive 74% compared to last year, while the value obtained by DEXs alone increased by 87%.

Interestingly, while Bitcoin has traditionally been seen as the proxy for the crypto ecosystem as a whole, research indicates that UAE investors actually have a strong preference for stablecoins. In fact, Bitcoin accounts for just 16.5% of the volume of cryptocurrencies received in the UAE, while stablecoins constitute over half (51.3%).

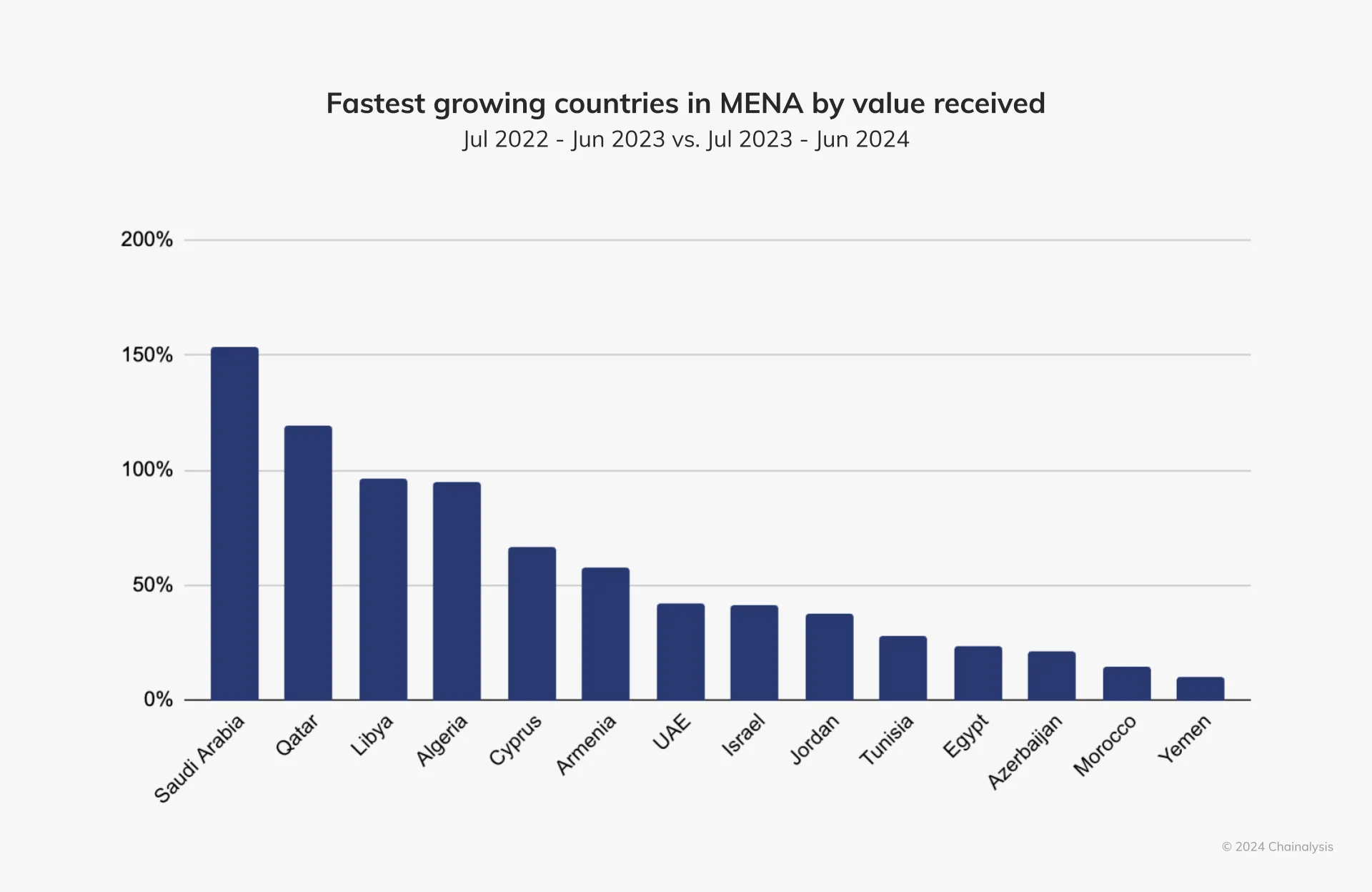

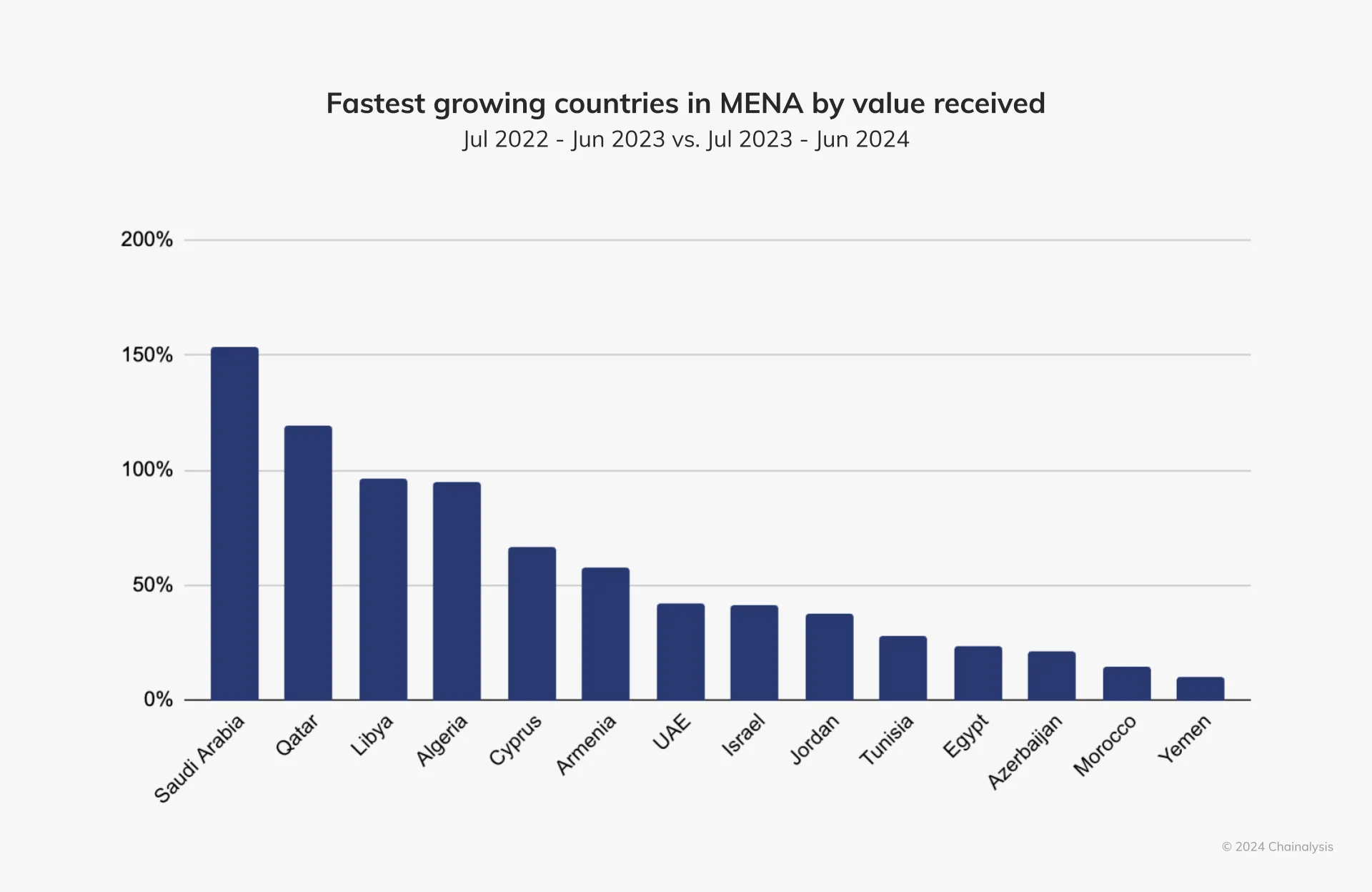

Saudi Arabia: The Fastest-Growing Crypto Market

Saudi Arabia has been recognized as one of MENA’s fastest-growing digital asset economies, boasting a year-on-year growth rate of 154%. Over the past year alone, the country received approximately $47,1 billion in cryptocurrencies– underscoring its rapid adoption of digital assets amid ongoing economic diversification efforts under Vision 2030. This ambitious plan aims to reduce Saudi Arabia’s dependence on oil revenues while fostering innovation across various sectors.

Saudi Arabia’s demographic profile influences the dynamics of its crypto market. Approximately 63% of its population is under 30, which tends to be more open to adopting new technologies such as cryptocurrencies and blockchain solutions.

While Bitcoin’s share of the total crypto volume in Saudi Arabia is only 16.4%, this reflects a broader preference for less volatile assets among local investors increasingly exploring altcoins and stablecoins as viable alternatives for wealth preservation and investment diversification. In addition to traditional cryptocurrencies like Bitcoin and Ethereum, there is growing interest in emerging tokens that offer unique use cases or technological advantages.

Furthermore, Saudi Arabia’s regulatory framework is evolving rapidly to accommodate this growing interest in digital assets. The Saudi Central Bank has initiated several pilot projects exploring central bank digital currencies (CBDCs), which could revolutionize payment systems while enhancing financial inclusion for underserved populations.

The Rise of Decentralized Finance (DeFi)

Another notable trend within MENA’s cryptocurrency sector is the increasing adoption of decentralized finance (DeFi). While centralized exchanges (CEXs) continue to dominate trading volumes across most countries in the region, Saudi Arabia and the UAE are witnessing remarkable growth in DEX activity. Approximately 30.9% and 32.4% of total crypto transaction volume originated from decentralized exchanges, respectively—well above the global average.

This shift toward DeFI indicates growing investors’ acceptance of financial solutions that offer greater accessibility and flexibility than traditional banking systems. DeFI platforms enable users to lend or borrow assets without intermediaries while earning interest on their holdings through liquidity pools– an attractive proposition for many investors seeking higher investment returns. In addition to facilitating peer-to-peer transactions without intermediaries, DeFI platforms also provide opportunities for yield farming– a process where users can stake their cryptocurrencies to earn rewards or interest over time– further incentivizing participation from retail and institutional investors alike.

The UAE’s proactive regulatory stance has been instrumental in promoting DeFi’s growth. It provides clarity that encourages local startups and international players to establish operations within its borders while ensuring consumer protection measures are upheld throughout this burgeoning sector.

Challenges Facing MENA’s Crypto Sector

Despite the rapid growth and increasing adoption of cryptocurrencies in the MENA region, several challenges persist that could hinder further development and integration of digital assets into the mainstream financial ecosystem. One of the primary concerns is regulatory uncertainty. While countries like the UAE have made significant strides in establishing clear regulatory frameworks that promote innovation, other nations within MENA still lack comprehensive regulations governing cryptocurrency activities. This inconsistency can create a fragmented market environment, deterring potential investors and businesses from entering the space due to fears of compliance risks or legal repercussions.

Additionally, the region faces challenges related to cybersecurity and fraud. The Chainalysis report highlights a worrying increase in cybercrime that has mirrored the rapid mainstream adoption of cryptocurrency. In 2023 alone, illicit activities accounted for $24.2 billion in value received by addresses associated with illegal transactions, emphasizing the need for enhanced security measures and consumer protection protocols.

Lastly, while decentralized finance (DeFi) is gaining traction in MENA, it also presents its setbacks. The rapid growth of DeFI platforms raises concerns regarding regulatory oversight and consumer protection, as these platforms operate outside traditional banking systems. Ensuring that users are adequately informed about the risks associated with DeFI investments will be crucial for fostering trust and encouraging broader participation in this sector.

Future Prospects for the MENA Crypto Ecosystem

Looking ahead to 2025, the MENA region’s cryptocurrency ecosystem is poised for growth, particularly in the UAE, which is expected to lead in crypto adoptions. Projections indicate that the number of active cryptocurrency users in the UAE will reach 700,000 by the end of 2024, up from 500,000 daily trades recorded in early 2024. A recent survey revealed that 72% of UAE crypto adopters have already invested in Bitcoin, demonstrating a strong preference for major cryptocurrencies. Additionally, 29% of respondents believe digital assets are more practical than traditional currencies. Furthermore, the UAE aims to double the share of its digital economy in GDP from 9.7% to 19.4% over the next decade, supported by favorable regulatory conditions and increasing crypto adoptions.

These developments suggest a promising trajectory for the MENA region as it solidifies its position as a key player in the global crypto landscape.

Source: The 2024 Geography of Crypto Report from Chainalysis

The Middle East and North Africa (MENA) region is experiencing a remarkable transformation in its financial landscape, rapidly emerging as a significant player in the global cryptocurrency market. As of 2024, MENA ranks as the seventh-largest crypto market worldwide, with an astounding on-chain value of $338.7 billion received between July 2023 and June 2024. This figure represents approximately 7.5% of the total global transaction volume. The increase in activity is not just a reflection of market size; it indicated a burgeoning interest in cryptocurrencies driven by institutional and retail investors across various regional countries.

Notably, MENA’s crypto market has witnessed a year-on-year growth rate of 11.73%, underscoring its resilience and adaptability in a rapidly changing financial environment. Most on-chain activity in the region occurs on decentralized exchanges (DEXs), with 32.4% of transactions in the United Arab Emirates (UAE) and 30.9% in Saudi Arabia taking place on these platforms.

The concentration of crypto activity within MENA is particularly noteworthy, with a few key players dominating the scene. Turkey leads the region as its largest crypto marketer, securing the 11th position globally with $137 billion in value received during this reporting period. Morocco follows closely, ranking 27th globally with $12.7 billion in crypto transactions. Most of the transactions within MENA are substantial, with an impressive 93% of value transferred coming from transactions exceeding $10,000.

Turkey: The Regional Leader in Crypto Adoption

Turkey has emerged as the largest crypto market in the MENA region, with a staggering $137 billion received during the reporting period. This dominance can be attributed to several economic factors, including exceptionally high inflation rates that have persisted near or above 50%. As citizens grapple with financial instability and currency devaluation, many have turned to cryptocurrencies as a hedge against inflation and a means to preserve their wealth. Estimates suggest that approximately 40% to 50% of Turkey’s population engages with cryptocurrencies, showcasing a significant shift toward digital assets as investment opportunities and financial safeguards.

In addition to inflationary pressures, Turkey’s unique regulatory landscape plays a crucial role in shaping its crypto market. The country has seen increased interest from local and international exchanges, enhancing liquidity and trading volumes. Furthermore, Turkey leads the world in stablecoin trading volume relative to its GDP, indicating a strong preference for stable digital assets among its citizens. This trend reflects broader consumer behavior where individuals seek stability amidst economic uncertainty, driving demand for stablecoin like Tether (USDT) and USD Coin (USDC).

In addition to these economic factors, Turkey’s tech ecosystem fosters innovation within the crypto space. Local startups are developing blockchain-based solutions catering to domestic and international markers. For instance, Turkish fintech companies are exploring applications for blockchain technology across various sectors, including supply chain management and remittances. This entrepreneurial spirit is supported by government initiatives to promote technological advancements and digital literacy among the population.

The UAE: A Hub for Institutional Investment

The United Arab Emirates (UAE) has emerged as a formidable player in MENA’s cryptocurrency landscape, ranking third with over $34 billion received between July 2023 and June 2024. This figure represents a year-on-year growth rate of 42%, outpacing the regional average of 11.73%. The UAE’s crypto activity spans all transaction sizes: small and large retail transactions, each growing by over 80%. Additionally, professional transactions increased by 46.3%, while institutional transfers surged by 55.07%. This balanced growth indicates a mature market where retail and institutional investors actively participate.

The UAE’s regulatory environment plays a huge role in fostering this growth. Authorities like the Dubai Virtual Assets Regulatory Authority (VARA) have established forward-focused regulations encouraging innovation while ensuring consumer protection. The introduction of clear regulatory frameworks has attracted numerous international firms looking to establish operations within the UAE’s borders, positioning Dubai as a global hub for cryptocurrency exchanges and blockchain startups.

Moreover, decentralized finance (DeFi_ services have gained substantial traction within the UAE’s crypto ecosystem. The total value received by DeFi services grew by an impressive 74% compared to last year, while the value obtained by DEXs alone increased by 87%.

Interestingly, while Bitcoin has traditionally been seen as the proxy for the crypto ecosystem as a whole, research indicates that UAE investors actually have a strong preference for stablecoins. In fact, Bitcoin accounts for just 16.5% of the volume of cryptocurrencies received in the UAE, while stablecoins constitute over half (51.3%).

Saudi Arabia: The Fastest-Growing Crypto Market

Saudi Arabia has been recognized as one of MENA’s fastest-growing digital asset economies, boasting a year-on-year growth rate of 154%. Over the past year alone, the country received approximately $47,1 billion in cryptocurrencies– underscoring its rapid adoption of digital assets amid ongoing economic diversification efforts under Vision 2030. This ambitious plan aims to reduce Saudi Arabia’s dependence on oil revenues while fostering innovation across various sectors.

Saudi Arabia’s demographic profile influences the dynamics of its crypto market. Approximately 63% of its population is under 30, which tends to be more open to adopting new technologies such as cryptocurrencies and blockchain solutions.

While Bitcoin’s share of the total crypto volume in Saudi Arabia is only 16.4%, this reflects a broader preference for less volatile assets among local investors increasingly exploring altcoins and stablecoins as viable alternatives for wealth preservation and investment diversification. In addition to traditional cryptocurrencies like Bitcoin and Ethereum, there is growing interest in emerging tokens that offer unique use cases or technological advantages.

Furthermore, Saudi Arabia’s regulatory framework is evolving rapidly to accommodate this growing interest in digital assets. The Saudi Central Bank has initiated several pilot projects exploring central bank digital currencies (CBDCs), which could revolutionize payment systems while enhancing financial inclusion for underserved populations.

The Rise of Decentralized Finance (DeFi)

Another notable trend within MENA’s cryptocurrency sector is the increasing adoption of decentralized finance (DeFi). While centralized exchanges (CEXs) continue to dominate trading volumes across most countries in the region, Saudi Arabia and the UAE are witnessing remarkable growth in DEX activity. Approximately 30.9% and 32.4% of total crypto transaction volume originated from decentralized exchanges, respectively—well above the global average.

This shift toward DeFI indicates growing investors’ acceptance of financial solutions that offer greater accessibility and flexibility than traditional banking systems. DeFI platforms enable users to lend or borrow assets without intermediaries while earning interest on their holdings through liquidity pools– an attractive proposition for many investors seeking higher investment returns. In addition to facilitating peer-to-peer transactions without intermediaries, DeFI platforms also provide opportunities for yield farming– a process where users can stake their cryptocurrencies to earn rewards or interest over time– further incentivizing participation from retail and institutional investors alike.

The UAE’s proactive regulatory stance has been instrumental in promoting DeFi’s growth. It provides clarity that encourages local startups and international players to establish operations within its borders while ensuring consumer protection measures are upheld throughout this burgeoning sector.

Challenges Facing MENA’s Crypto Sector

Despite the rapid growth and increasing adoption of cryptocurrencies in the MENA region, several challenges persist that could hinder further development and integration of digital assets into the mainstream financial ecosystem. One of the primary concerns is regulatory uncertainty. While countries like the UAE have made significant strides in establishing clear regulatory frameworks that promote innovation, other nations within MENA still lack comprehensive regulations governing cryptocurrency activities. This inconsistency can create a fragmented market environment, deterring potential investors and businesses from entering the space due to fears of compliance risks or legal repercussions.

Additionally, the region faces challenges related to cybersecurity and fraud. The Chainalysis report highlights a worrying increase in cybercrime that has mirrored the rapid mainstream adoption of cryptocurrency. In 2023 alone, illicit activities accounted for $24.2 billion in value received by addresses associated with illegal transactions, emphasizing the need for enhanced security measures and consumer protection protocols.

Lastly, while decentralized finance (DeFi) is gaining traction in MENA, it also presents its setbacks. The rapid growth of DeFI platforms raises concerns regarding regulatory oversight and consumer protection, as these platforms operate outside traditional banking systems. Ensuring that users are adequately informed about the risks associated with DeFI investments will be crucial for fostering trust and encouraging broader participation in this sector.

Future Prospects for the MENA Crypto Ecosystem

Looking ahead to 2025, the MENA region’s cryptocurrency ecosystem is poised for growth, particularly in the UAE, which is expected to lead in crypto adoptions. Projections indicate that the number of active cryptocurrency users in the UAE will reach 700,000 by the end of 2024, up from 500,000 daily trades recorded in early 2024. A recent survey revealed that 72% of UAE crypto adopters have already invested in Bitcoin, demonstrating a strong preference for major cryptocurrencies. Additionally, 29% of respondents believe digital assets are more practical than traditional currencies. Furthermore, the UAE aims to double the share of its digital economy in GDP from 9.7% to 19.4% over the next decade, supported by favorable regulatory conditions and increasing crypto adoptions.

These developments suggest a promising trajectory for the MENA region as it solidifies its position as a key player in the global crypto landscape.

Login

Login