Economic pressure can compel Tehran to moderate its destructive behavior and end its pursuit of nuclear weapons. Crude and natural gas exports historically account for 25% of government revenues: it is therefore important to accurately track Iran’s oil exports to interpret if sanctions are effectively stopping the flow of revenue to the regime.

This can be difficult given the regime’s track-record of smuggling and sanctions evasion techniques and there is little consensus among oil tracking agencies about how much is getting through, and to where.

This variance mars the accuracy of media reports, but it also presents a serious challenge to those trying to get a handle on the trajectory of the Iranian economy, given its oil revenue dependency.

More importantly, a correct accounting of quantities and destinations will help focus limited resources to where they are really needed: which shippers, which vessels, which areas, which ports, which flags, which insurers.

UANI has therefore sought to address the information gap with a new comprehensive ship-tracking methodology.

Using Automatic Identification System (AIS), satellite imagery, vessel comparison and tanker classification, and cargo datasets to uncover all under-the-radar ship-to-ship (STS) transfers and exports of Iranian oil and gas condensates, we generate what we contend are the most accurate figures available.

This resource seeks to disrupt Iran’s attempts to generate profits from oil sales and further isolate the regime economically.

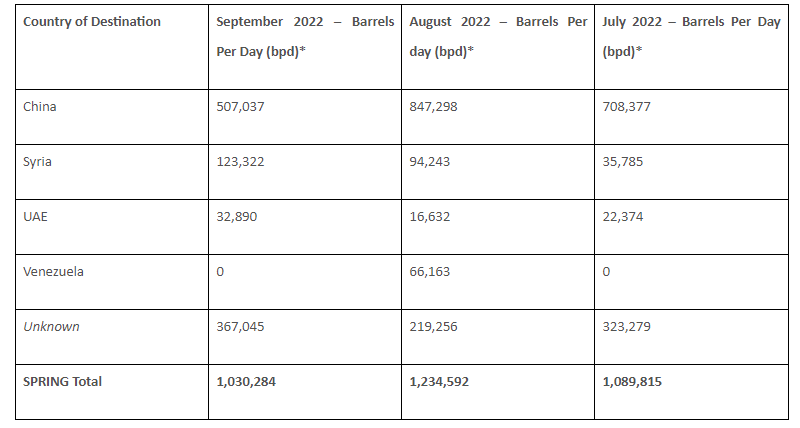

September 2022 Iran Tanker Tracking

At a press briefing on September 26, State Department Spokesperson Ned Price was asked three times whether the U.S. was “OK” with giving the Iranian regime billions of dollars in sanctions relief to further repress their own people, for the sake of a new nuclear deal. “It’s not like they’re going to be using that money to plant flowers in downtown Tehran,” noted AP reporter Matt Lee, while Iranian authorities are presently brutalizing thousands of anti-regime protesters in the wake of the murder of Mahsa (Jina) Amini for “incorrect hijab.”

As well as immediate sanctions relief, Mr. Lee also noted that a deal would bring in additional billions by “allowing them to sell their oil on the open market…” Even on the black market, as UANI has documented since 2018, Iran has been doing an excellent job of selling its oil and gas, mainly to China. Since January 2021, Iran has received $38 billion in oil revenues – a now widely reported figure – despite the technical existence of U.S. sanctions that prohibit all Iran oil trade.

While State Department Spokesperson Ned Price sought to downplay such eye-watering numbers as subject to a “margin of error” (the Department’s own estimate was not divulged), it is clear that the Administration is at least increasingly appreciative of the issue’s significance. One day later, on September 29, the State Department announced new sanctions on ten oil trade facilitators including a Chinese crude-oil storage operator, Zhonggu Storage and Transportation Co Ltd. “as the Biden administration looks for ways to sever [this] financial lifeline…” As the New York Times noted in its report citing UANI data, “[t]he sanctions against Chinese companies could also presage a tense confrontation with Beijing over its substantial purchases of Iranian oil, which have provided Iran’s government with a badly needed windfall, to the frustration of the Biden administration…” Since “quiet diplomacy” with Beijing has clearly not succeeded in this arena, perhaps a more assertive approach is indeed required.

For those concerned with the regime’s ability to further brutalize its own people, it is also worth noting that with Russian supplies offline for the foreseeable future, Iranian oil exports would conceivably jump in time to 2 million bpd should a new deal be reached. Moreover, open market sales would end the current necessity to provide big discounts, giving an extra boost to both the regime’s coffers and its oppressive bandwidth.

During September, while confronting uprisings in more than 80 locations in almost every one of Iran’s 31 provinces, Iran again had little problem selling more than 1 million barrels of oil per day (bpd) through subterfuge, and ongoing ship-to-ship (STS) transfers (often in Indonesian, Malaysian and Singaporean waters, as we describe below).

Login

Login